This is your very first post. Click the Edit link to modify or delete it, or start a new post. If you like, use this post to tell readers why you started this blog and what you plan to do with it.

This is your very first post. Click the Edit link to modify or delete it, or start a new post. If you like, use this post to tell readers why you started this blog and what you plan to do with it.

So the purpose of this article is to assist calm those anxieties. Maybe I can not eliminate them totally, but I do wish you find some comfort in exactly what I’m about to inform you. Do you have any type of concept the number of tax returns are audited annually?

About 2%, offer or take a few tenths of a percent, depending on what does it cost? loan you make, what sort of organisation entity you own, the dimension of your service, and also where you live. Audit prices differ somewhat from one component of the area to another.

Think of this for a minute. Your opportunities of obtaining audited are possibly about 4 in a 200. Do you like those odds? I sure wish so. The Internal Revenue Service doesn’t have the sources to carry out vast scale audits. That’s simply the method it is. Just how should this great news regarding IRS audit prices impact you? Instead of fearing an IRS audit, right here are three reasons to take advantage of the unlikely possibility of being investigated.

When it concerns your perspective towards the IRS, cheer up as well as take heart. The possibility of an audit is slim. I satisfy individuals everyday that appear to be well-adjusted as well as successful, however just bring up those dreaded letters IRS, as well as they become a paranoid basket-case. There’s no need for such illogical concern. You have actually seen the numbers. Allow the realities control your feelings, not myths and also false impressions. Maintain these audit rates in mind when deciding what deductions to take. I am not recommending that you rip off on your tax returns, yet I am suggesting that you take into consideration being a lot more hostile. If the thing in question is not fraud, as well as if you contend the very least a feasible position, these reduced audit rates lend value to the old claiming when in doubt, subtract it.

Beginning your own business can be an unbelievably rewarding, and also challenging, experience. First you dream, then you turn that vision into something tangible. Perhaps you begin your desire by becoming part of a collaboration with various other like minded entrepreneurs or possibly you go it alone as a company of one. Eventually your services or product will be available for all the globe to see and also the profits will certainly soon comply with. With success comes duty, which normally takes the type of taxes when it comes to expanding companies. If you are in the fortunate setting of being your own employer or job individually, you might be required to submit self employment taxes. This short introduction will aid you recognize the ins and also outs of this type of taxation so that you can submit with self-confidence in the years ahead.

For many workers, taxes are immediately subtracted from each paycheck by the company. These taxes most likely to the well-being administration, contributing to Medicare as well as Social Safety benefits that the staff member might be eligible to gather later on. As a business companion or proprietor, it is crucial that you file the appropriate tax obligations to ensure that you continuously pay right into your welfare benefits. By being positive as well as appropriately filing your tax obligations now, you can feel confident that your well-being advantages will certainly be waiting on you if when you require them.

In numerous situations, both the employer and also the staff member pay a section of the person’s employment tax. Given that you are essentially your personal employee and also company as an entrepreneur, you are in charge of paying the total. The self utilized tax obligation price may differ from year to year inning accordance with adjustments in the economy, but the tax itself approaches the typical employment tax obligation rate.

Much like the a lot more standard work tax, the quantity of tax obligations a self-employed person owes is calculated by thinking about a few various elements. The initial, as well as key, variable is the business’s net earnings. Your web earnings can be figured by subtracting any type of feasible allocations as well as reductions from your firm’s gross income. The type of company you have may also impact how much you owe in taxes. Another component to take into consideration when determining your tax obligations is if you are both self-employed as well as utilized by one more. If you fall into both classifications, you might owe self-employment and also work taxes.

It could seem intimidating to calculate your self-employment taxes, yet do not allow it hold you back. Now that you have a general understanding of exactly how

financial audits these taxes as compare to common work taxes, as well as how they are figured, you have the structure of knowledge that you should dig deeper. If you have inquiries regarding anything concerning ways to submit taxes as an independent individual, all you have to do is ask. Tax consultants are professionals on the topic, while your fellow entrepreneur can be anxious to offer practical words of wisdom on their own experiences. So the next time April 15th rolls around, just remember you’re the boss.

The low audit prices must not provide you need to become sloppy in your document keeping. That should maintain accurate records of revenue and expenditure, even if the odds of an audit are low? You do. If you are significant concerning achieving success in organisation, you will want to know how the business is doing, right? As well as if you think that a positive bank account equilibrium is a precise sign of the success or failure of your company, you are mistaken.

Successful entrepreneur maintain their finger on the pulse of their service weekly. They recognize how much is being available in and also they know what does it cost? is going out. Effective company owner preserve precise financial records so they can make sound company decisions to boost sales, reduce costs, as well as increase profits. If your perspective is anything much less compared to that, your service is destined fail. While the opportunities of being audited are low, so are the possibilities of succeeding without great documents.

Repayment of taxes is an unavoidable responsibility for an entrepreneur or an entrepreneur. Federal government constantly utilizes to examine the standing of tax obligation payment at the normal period and also examine if you have paid the proper amount of tax obligation. If you want to pay sales tax obligation to the government with no problems by adhering to the government’s regulations and law, you have to go to the tax auditor like state sales tax obligation who has been giving totally professional auditing solutions for greater than 7 years. Occasionally, you are not able to present your sales tax obligation that you have actually currently paid. You must follow the below mentioned ideas to present your sales tax correctly.

The primary step in filing tax obligations for your company is to obtain the proper documents from the IRS. For new company owner, the paperwork should be fairly direct, with the kinds stating just what items and also amounts should be recorded.The documents must also ask you a couple of straight-forward inquiries about you and also your business; all of which need to be answer completely.

These inquiries consist of things like when you began business, what goods or solutions does it offer, where is business located, as well as do you have employees. The most vital forms to have on hand are your bookkeeping documents. These need to consist of any kind of car loans, expenses, organisation associated expenses, sales profits, cost of manufacturing, and other form of loan that has actually gone into your company whatsoever.

Make certain that everything recorded is done so appropriately as well as in the ideal categories as well as accounts. As an example, do not submit worker salaries under making costs. Production expenses need to just include the price of materials that make the products you are using, and employee incomes should be filed under labour prices. You likewise need to decide if your firm is running on a cash or accrual based audit system. A cash-based system means you recognise inbound or outgoing loan when it is either transferred in your account or paid to a third party. An amassing based system implies you acknowledge inbound or outbound loan when it is earned, even if it is not yet paid.

For example, allow’s claim you buy a huge quantity of steel from a firm and opt to settle the purchase in month-to-month batches.

On a cash-based system, you log in the bookkeeping publications the repayment each month when you create a check to the steel business. On an accrual based system, you log in the entire lump sum the month that the initial acquisition was made. The majority of financial institutions like logs that are worked on an accrual based system, yet several business run on a cash-based system. Whichever system you choose for your firm, make sure it corresponds throughout to stay clear of any type of confusion. Another thing to record on your tax return is whether or not you run your business from your residence. If you do you might declare a part of your house as a tax reduction for your organisation.

Since this is a sensitive subject with a background of scams, your home should have a designated area that is made use of for the single

investigative audits use of the company. This area’s square video footage have to be measured, and also the square footage of your home of a whole have to be determined. After that it needs to be determined what percent of the residence is being made use of for the single purpose of the firm. That percentage of residence costs, property taxes, home mortgage, as well as utilities might be represented as home-office expenditures as well as be claimed as a deductible for business. Entrepreneur ought to also file automobile expenditures that belong to their business. For new and young business, there might be a lot of travel involved, as well as paying for gasoline as well as vehicle upkeep can get extremely pricey the initial year.

You need to keep a log in your auto of where you travelled to, that you mosted likely to meet with, when you took a trip there, exactly how far was the location, and just how much you spent in gas money. When declaring taxes as well as asserting automobile costs, you have to specify every one of these things, and how the trip mattered and deliberate to your company. When doing your taxes, make certain to take into consideration the self-employment tax. Things like social security as well as Medicare taxes are typically forgotten, and actually represent a big section of tax obligations payable for independent business owners. Make sure to consist of these in your total quarterly tax payments, and also keep in mind that you are not only required to pay for the previous year’s taxes, however, for the first quarter of the list below year.

This is just one of the most vital things to prepare all data and also details for your sales tax in an appropriate way. It could be feasible that you have paid even more to the tax collection agency. In such circumstance, auditor will certainly check the precision and also validity of the amount. You have to show him your sales income tax return, graphes of accounts, business book, sales billings, federal income in addition to all important records connected to your business. Thus, you have to prepare your all purchases throughout the year completely to ensure that you could reveal it at the time of auditing. You ought to quickly seek advice from to a sales tax professional in situation of any kind of troubles concerning your sales tax audit. Choosing a sales tax get in touch with, you should aware that they have great deals of experience in handling sales tax and could compute sales tax obligation rates accurately as well as arrange essential documentation for audit. A sales tax obligation audit can be tiresome as well as lengthy. Often, the auditor should conduct a 2nd audit for examining the extra detailed info of your sales records. You should constantly prepare for it to prevent the auditor’s time. In addition, you must additionally keep your sales register as well as the exception certificates for the second audit.

You might also appeal your case if you discover that tax auditor’s findings are not proper. In this instance, you have to prepare with all the pertinent files to defend yourself. Without knowing the appropriate charm for the certain disagreement resolution, you can not win your fight available for sale income tax return. For this, you have to get in touch with to a trustworthy and also experienced sales tax obligation consultant that can represent your documents correctly so that you can really feel safe and secure on your own. State sales tax could be among the best choices for your sales tax obligation audit who could supply you fully expert services according to your economic requirements and also requirements.

Repayment of tax obligations is an inevitable obligation for a business owner or an entrepreneur. Federal government constantly makes use of to examine the condition of tax payment at the normal interval and examine if you have paid the appropriate amount of tax obligation. If you wish to pay sales tax to the federal government with no troubles by complying with the federal government’s regulations and guideline, you must most likely to the tax obligation auditor like state sales tax obligation who has been offering entirely expert bookkeeping solutions for more than 7 years. Often, you are unable to provide your sales tax obligation that you have actually already paid. You must adhere to the below

on-site audits stated ideas to offer your sales tax correctly.

The very first step in filing taxes for your company is to obtain the proper documentation from the Internal Revenue Service. For new company owner, the documentation should be rather simple, with the types specifying just what items and also quantities need to be recorded.The documents should additionally ask you a couple of straight-forward questions concerning you as well as your organisation; all which need to be response totally. These questions include points like when you began business, what items or solutions does it provide, where is business situated, and also do you have staff members. One of the most crucial types to carry hand are your audit documents. These ought to consist of any type of fundings, costs, service associated costs, sales profits, cost of manufacturing, and any other type of loan that has actually entered into your firm in all.

See to it that everything documented is done so properly and also in the ideal categories and accounts. As an example, do not file staff member incomes under manufacturing costs. Production costs need to just include the cost of products that make the products you are supplying, and also employee wages need to be submitted under work costs.

You additionally have to choose if your business is operating on a cash or accrual based bookkeeping system. A cash-based system implies you recognise incoming or outbound money when it is either deposited in your account or paid to a third party. An amassing based system implies you acknowledge incoming or outward bound cash when it is made, also if it is not yet paid.

As an example, allow’s claim you acquire a big quantity of steel from a firm and also opt to repay the acquisition in monthly batches. On a cash-based system, you visit the bookkeeping books the payment each month when you write a check to the steel business. On an amassing based system, you visit the entire lump sum the month that the initial purchase was made. A lot of banks like logs that are operated on an amassing based system, however lots of business run on a cash-based system. Whichever system you choose for your firm, see to it it is consistent throughout to stay clear of any type of complication. One more point to document on your tax return is whether or not you run your company from your house. If you do you may assert a section of your home as a tax obligation deduction for your organisation.

Given that this is a touchy topic with a history of scams, your home should have a designated area that is used for the sole use of the company. This location’s square footage should be determined, as well as the square footage of your home of an entire have to be determined. Then it should be computed what percent of the home is being used for the single purpose of the company. That portion of home expenses, real estate tax, mortgage, and energies may be represented as home-office expenditures and be asserted as a deductible for the business. Entrepreneur must also submit car expenditures that belong to their company. For brand-new and also young companies, there could be a lot of travel involved, and also paying for gasoline and automobile upkeep could get extremely costly the very first year.

You need to maintain a log in your car of where you travelled to, that you mosted likely to meet, when you took a trip there, how far away was the destination, and how much you spent in gas cash. When filing for taxes and asserting automobile costs, you need to mention all of these points, and just how the journey mattered as well as deliberate to your company. When doing your taxes, make certain to consider the self-employment tax. Points like social security and Medicare taxes are often neglected, as well as in fact make up a large portion of taxes payable for freelance company owner. Make certain to consist of these in your overall quarterly tax obligation settlements, as well as remember that you are not only needed to spend for the previous year’s tax obligations, but also for the initial quarter of the list below year.

This is among the most essential things to prepare all information and details for your sales tax in a correct fashion. It could be feasible that you have actually paid even more to the tax enthusiast. In such scenario, auditor will certainly examine the accuracy and legitimacy of the amount. You need to reveal him your sales tax returns, charts of accounts, corporate book, sales invoices, federal earnings along with very important records connected to your business. Thus, you have to prepare your all transactions throughout the year completely so that you could reveal it at the time of bookkeeping. You need to promptly seek advice from to a sales tax consultant in situation of any troubles regarding your sales tax obligation audit. Selecting a sales tax get in touch with, you need to mindful that they have great deals of experience in dealing with sales tax obligation and also could calculate sales tax prices accurately as well as arrange needed paperwork for audit. A sales tax audit could be tiresome in addition to taxing. Occasionally, the auditor has to carry out a second audit for checking out the a lot more detailed info of your sales records. You need to always get ready for it to prevent the auditor’s time. Moreover, you should also keep your sales register as well as the exception certificates for the second audit.

You may likewise appeal your instance if you discover that tax auditor’s searchings for are not proper. In this situation, you need to be ready with all the relevant records to defend yourself. Without knowing the correct charm for the specific conflict resolution, you could not win your fight to buy income tax return. For this, you need to consult to a trustworthy and also experienced sales tax expert who might represent your files properly to ensure that you can really feel secure on your own. State sales tax could be just one of the most effective choices for your sales tax obligation audit that can give you fully specialist services inning accordance with your economic demands and also demands.

The very function of this post is in order to help calm those anxieties. Maybe I cannot remove them entirely, but I do wish you discover some comfort in exactly what I will tell you. Do you have any type of suggestion the amount of tax returns are audited every year? About 8%, offer or take a few tenths of a percent, depending upon what does it cost? money you make, what sort of business entity you possess, the dimension of your business, as well as where you live. Audit rates differ somewhat from one part of the county to another.

Consider this for a moment. Your chances of getting audited are most likely regarding 5 in a 100. Do you like those probabilities? I sure really hope so. The IRS doesn’t have the resources to perform vast range audits. That’s simply the way it is. Just how should this good information concerning IRS audit prices result you? As opposed to fearing an Internal Revenue Service audit, here are three needs to gain from the unlikely possibility of being investigated.

When it pertains to your perspective towards the IRS, comfort as well as take heart. The chance of an audit is slim. I fulfill people daily that appear to be well-adjusted and effective, but just raise those feared letters IRS, and they become a paranoid basket-case. There’s no demand for such irrational fear. You’ve seen the numbers. Allow the truths manage your feelings, not misconceptions and also false impressions. Keep these audit rates in mind when deciding exactly what deductions to take. I am not recommending that you rip off on your income tax return, yet I am suggesting that you think about being more hostile. If the item concerned is not fraudulence, and if you contend the very least an arguable position, these reduced audit rates offer advantage to the old saying when doubtful, deduct it.

Starting your personal business could be an exceptionally fulfilling, and challenging, experience. First you dream, then you turn that vision right into something tangible. Probably you commence your desire by becoming part of a partnership with various other like minded business owners or maybe you go it alone as a business of one. At some time your product and services will certainly be available for all the globe to see and also the profits will quickly adhere to. With success comes obligation, which typically takes the type of taxes in the case of expanding businesses. If you remain in the privileged placement of being your very own manager or work individually, you might be required to file self work taxes. This quick introduction will assist you understand the ins and also outs of this kind of taxes to ensure that you could file with confidence in the years ahead.

For a lot of employees, taxes are immediately deducted from each paycheck by the company. These tax obligations go to the well-being administration, adding to Medicare as well as Social Protection advantages that the employee might be qualified to collect later on. As a service partner or owner, it is essential that you file the ideal tax obligations to make sure that you remain to pay into your well-being advantages. By being positive as well as correctly submitting your taxes currently, you can rest assured that your welfare advantages will be waiting on you if when you require them.

In numerous circumstances, both the company as well as the staff member pay a part of the person’s employment tax. Since you are basically your very own staff member as well as company as a local business owner, you are in charge of paying the full amount. The self utilized tax price may vary from year to year inning accordance with changes in the economic climate, however the tax itself is comparable to the conventional employment tax obligation price.

Much like the more typical work tax obligation, the amount of tax obligations an independent individual owes is calculated by thinking about a couple of various elements. The initial, as well as key, factor is business’s net incomes. Your internet revenues can be figured by subtracting any feasible allocations and also reductions from your business’s gross earnings. The kind of business you have could also influence just how much you owe in tax obligations. An additional component to take into account when determining your tax obligations is if you are both freelance and utilized by an additional. If you fall into both categories, you could owe self-employment as well as employment tax obligations.

It could appear intimidating to calculate your self-employment taxes, however do not allow it hold you back. Since you have a basic understanding of exactly how these taxes compare with common work tax obligations, and also just how they are figured, you have the structure of understanding that you need to dig further. If you have concerns regarding anything relating to the best ways to submit tax obligations as a self-employed person, all you need to do is ask. Tax obligation experts are specialists on the topic, while your fellow company owner could be eager to use helpful words of wisdom on their own experiences. So the next time April 15th rolls about, just remember you’re in

audit management systems charge.

The low audit rates must not offer you reason to end up being careless in your record maintaining. That has to maintain precise documents of revenue and expense, also if the probabilities of an audit are reduced? You do. If you are severe regarding achieving success in business, you will wish to know how business is doing, right? And if you believe that a positive checking account balance is a precise sign of the success or failing of your service, you are mistaken.

Effective local business owner maintain their finger on the pulse of their service every week. They know what does it cost? is can be found in and they know how much is heading out. Successful local business owner maintain accurate economic records so they can make sound business choices to boost sales, reduce costs, and also increase earnings. If your attitude is anything less than that, your company is doomed to stop working. While the opportunities of being examined are reduced, so are the possibilities of succeeding without good documents.

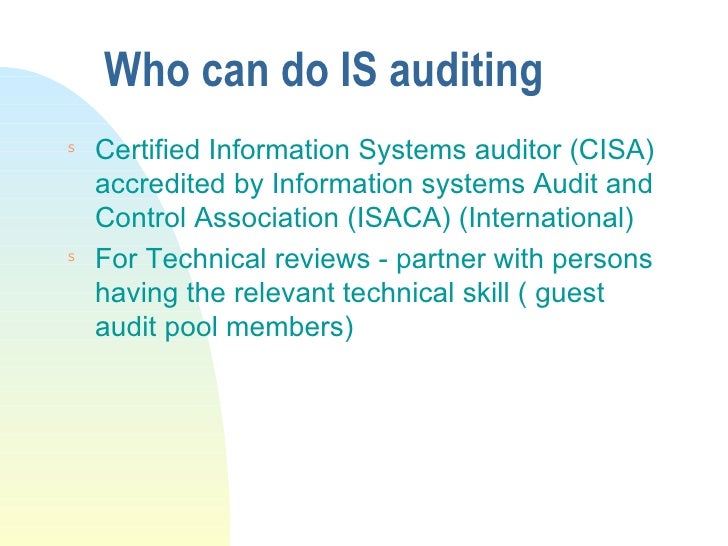

Auditing is the confirmation activity, such as inspection or exam, of a procedure or top quality system, to make certain conformity to demands. An audit can put on a whole organisation or may be certain to a function, procedure, or production action. Locate a lot more information in the video clip, The How as well as Why of Bookkeeping.

An audit is a “methodical, independent and recorded procedure for getting audit proof like documents, statements of truth or various other information which are relevant and verifiable and also reviewing it fairly to establish the extent to which the audit requirements based upon a collection of plans, procedures or requirements are met.” Several audit techniques might be employed to accomplish the audit objective.

There are 3 discrete types of audits: product and services, process, as well as system. Nonetheless, other methods, such as a workdesk or record testimonial audit, might be utilized individually or on behalf of the three basic types of audits.

Some audits are named according to their purpose or extent. The range of a division or function audit is a particular department or function. The function of an administration audit associates with management passions such as evaluation of area performance or efficiency.

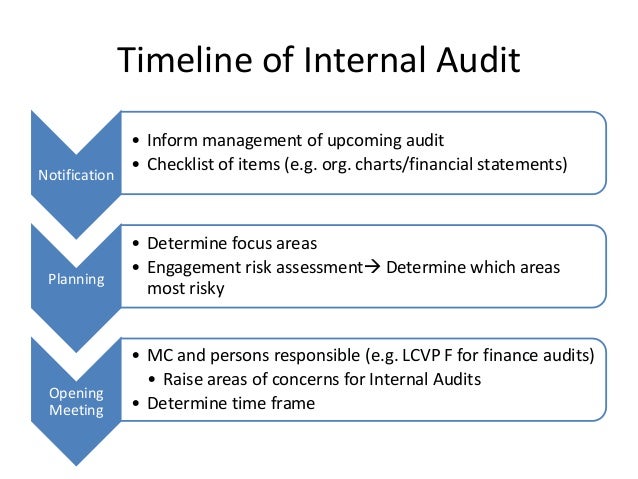

An audit might additionally be classified as inner or exterior, depending on the correlations among individuals. Internal audits are executed by staff members of your organisation. External audits are performed by an outside representative. Internal audits are typically described as first-party audits, while external audits can be either second-party, or third-party.

A product audit is an assessment of a particular service or product to evaluate whether it satisfies needs like requirements, performance standards, as well as client requirements. However, a process audit is a verification that refines are working within established restrictions. It reviews a procedure or method against fixed directions or requirements to determine correspondence to these standards and also the effectiveness of the directions. Such an audit may inspect uniformity to defined demands such as time, accuracy, temperature, pressure, structure, responsiveness, amperage, and part blend. Take a look at the resources tools, materials and people applied to transform the inputs right into outputs, the

irs audits environment, the methods procedures, instructions complied with, as well as the actions collected to determine procedure performance.

Check the adequacy and effectiveness of the procedure manages developed by treatments, work directions, flowcharts, and also training and also process specs.

A system audit is carried out on an administration system. It can be called a recorded activity performed to validate, by evaluation and analysis of unbiased proof, that relevant elements of the system are appropriate as well as efficient and also have been developed, recorded, and applied in accordance as well as in conjunction with given requirements. A high quality monitoring system audit examines an existing quality program to determine its uniformity to firm plans, contract dedications, and also regulative requirements.

Similarly, an ecological system audit analyzes an environmental monitoring system, a food security system audit checks out a food safety and security monitoring system, as well as security system audits examine the safety and security monitoring system. A first-party audit is done within an organisation to determine its staminas as well as weak points against its own procedures or approaches and/or against exterior standards embraced by (volunteer) or imposed on (necessary) the organisation. A first-party audit is an internal audit carried out by auditors who are utilized by the organisation being investigated however who have no vested interest in the audit outcomes of the location being audited. A 2nd celebration audit is an exterior audit carried out on a vendor by a consumer or by a gotten organisation in behalf of a customer. A contract is in place, and the items or solutions are being, or will be, supplied. Second-party audits go through the regulations of contract legislation, as they are offering legal direction from the consumer to the distributor. Second-party audits often tend to be extra official than first-party audits since audit outcomes might affect the customer’s acquiring choices.